A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. GAAP sets accounting standards so that financial statements can be easily compared from company to company. GAAP sets standards for a wide array of topics, from assets and liabilities to foreign currency and financial statement presentation. Using the newest goods means that your cost of goods sold is closer to market value than if you were using older inventory items.

Income Statements for Merchandising Companies and Cost of Goods Sold

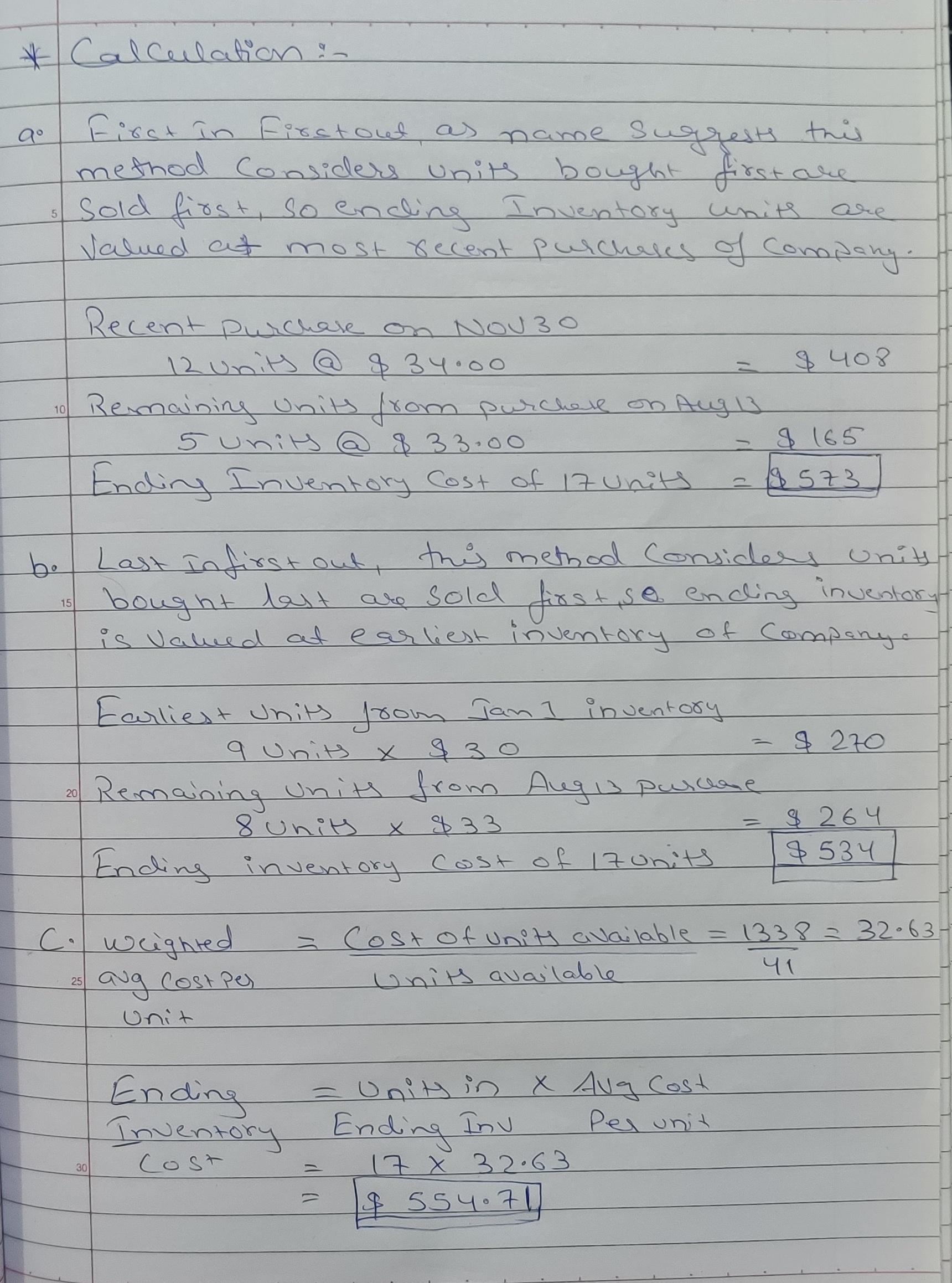

LIFO, or Last In, First Out, is an accounting system that assigns value to a business’s inventory. It assumes that newer goods are sold first and older goods are sold afterward. This is why LIFO creates higher costs and lowers net income in times of inflation.

- This method is exactly opposite to first-in, first-out method.

- We do not know what happens for the rest of the month because it has not happened yet.

- Being systematic is the key to understanding how the LIFO method works.

- If LIFO affects COGS and makes it more significant during inflationary times, we will have a reduced net income margin.

Problems Related to the LIFO Method

The example above shows how inventory value is calculated under a perpetual inventory system using the LIFO method. Deducting the cost of sales from the sales revenue gives us the amount of gross profit. For example, suppose a shop sells one of the two identical pairs of shoes in its inventory. One pair cost $5 and was purchased in January, and the second pair was purchased in February and cost $6 unit. In LIFO periodic system, the 120 units in ending inventory would be valued using earliest costs. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses.

Part 2: Your Current Nest Egg

Under the periodic inventory method, cost of goods sold is calculated at the end of the period only and recorded in one entry. The last-in, first-out (LIFO) method is one of the three inventory cost flow assumptions, alongside the FIFO (first-in, first-out) and average cost methods. You may have noticed that perpetual inventory gave you a slightly lower cost of goods sold that periodic did. Under periodic, how much does turbotax cost prices you wait until the end of the period and then take the most recent purchases, but under perpetual, we take the most recent purchases at the time of the sale. Under periodic, none of the beginning inventory units were used for cost purposes, but under perpetual, we did use some of them. Those less expensive units in beginning inventory led to a lower cost of goods sold under the perpetual method.

But the cost of the widgets is based on the inventory method selected. Last-In, First-Out method is used differently under periodic inventory system and perpetual inventory system. Let us use the same example that we used in FIFO method to illustrate the use of last-in, first-out method.

Here is an example of a business using the LIFO method in its accounting. In contrast, using the FIFO method, the $100 widgets are sold first, followed by the $200 widgets. So, the cost of the widgets sold will be recorded as $900, or five at $100 and two at $200.

This rule ensures consistency but can also lead to less favorable financial statements, as previously discussed. Additionally, businesses must file Form 970 with the IRS to elect LIFO, and once chosen, switching back to another inventory method can be cumbersome and may require IRS approval. Businesses often face the challenge of managing inventory costs effectively. One method that has garnered attention is Last In, First Out (LIFO).

This approach can be particularly beneficial for industries with rapid inventory turnover, such as retail and manufacturing, where the impact of inflation is felt more immediately. As before, we need to account for the cost of goods available for sale (5 books having a total cost of $440). With FIFO we assign the first cost of $85 to be the cost of goods sold.