All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. LIFO is best suited for situations in which inventory needs to remain life for ministers after opting out of social security up-to-date and turnover is high, such as in retail stores or warehouses. It is not recommended for situations where stock needs to remain consistent or bulk discounts are available.

What’s the difference between FIFO and LIFO?

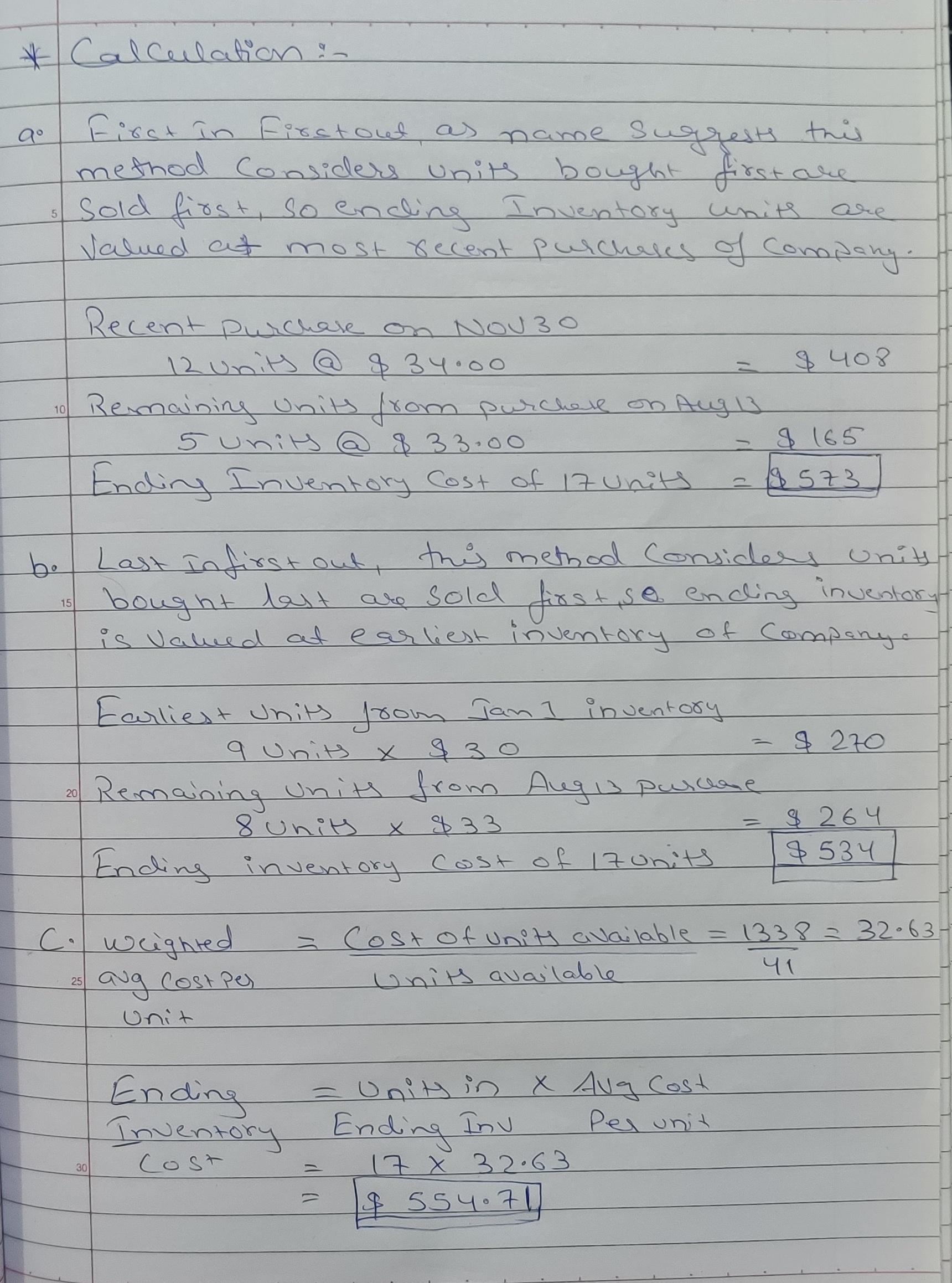

Under the last-in, first-out assumption, we always remove goods sold from the most recent purchase. This means that the goods sitting in the ending inventory are the earliest purchases. From Step 1, we know that there are 80 units in ending inventory. By looking at the purchases schedule in Step 2, we can assign costs to the 80 units by applying the oldest purchase price first. LIFO is an assumption about cost flow that doesn’t have to match the actual physical flow of goods. In the illustration above, it’s OK if the four physical paddles in beginning inventory were sold during the year.

Your Financial Accounting tutor

- So that’s going to be 800 units times the $20 price and that’s going to leave us with 800 times 20 is $16,000.

- This is because the latest and, in this case, the lowest prices are allocated to the cost of goods sold.

- If Kelly’s Flower Shop uses LIFO, it will calculate COGS based on the price of the items it purchased in March.

- When the trucks need to be filled, does the town take the salt from the top or bottom of the pile?

- By offsetting sales income with their highest purchase prices, they produce less taxable income on paper.

- Under LIFO, you assume that the last item entering inventory is the first one to be used.

We would do the entry on that date, which means we only have the information from January 7th and earlier. We do not know what happens for the rest of the month because it has not happened yet. Ignore all the other information and just focus on the information we have from January 1st to January 7th. To visualize how LIFO works, think of one of those huge salt piles that cities and towns keep to salt icy roads. When the trucks need to be filled, does the town take the salt from the top or bottom of the pile?

The difference between perpetual LIFO and periodic LIFO

By reducing taxable income through higher cost of goods sold (COGS), companies can retain more cash, which can be crucial for reinvestment or navigating economic uncertainties. This retained cash can be used to invest in new technologies, expand operations, or even buffer against future economic downturns. However, it’s important to note that while LIFO can provide short-term tax benefits, it may also result in lower reported earnings, which could affect investor perceptions and stock prices.

However, we’ve developed a spreadsheet to help you track LIFO layers if you don’t have the appropriate software. It’s good as it results in a lower recorded taxable income, giving businesses a lower tax bill. This can also be a negative for some companies, since lower reported profits may not be appealing to investors. Since LIFO uses the most recent, and therefore usually the more costly goods, this results in a greater expense recorded on a company’s balance sheet.

What Is the LIFO Method? Last-in, First-out Explained

In this lesson, I explain the easiest way to calculate inventory value using the LIFO Method based on both periodic and perpetual systems. On December 31, 2016, a physical count of inventory was made and 120 units of material were found in the store room. A trading company has provided the following data about purchases and sales of a commodity made during the year 2016. LIFO is a popular way to manage inventory for companies that need to sell newer products first.

So remember that in a periodic system, an inventory count, we’re physically going to count what’s left. It’s going to tell us how many, in this case, you know, for reselling cans of soda or something, it’ll tell us how many cans of soda we have left in our inventory. We’re going to have our beginning inventory and then we’re going to purchase stuff throughout the period and then what decreases our inventory is when we make sales, right? And that goes to cost of goods sold and leaves us with ending inventory. We’re adding one new little idea here in this top box and it’s the idea of goods available for sale, and this is just the beginning inventory plus the purchases, okay? So that’s a good note there is that those goods available for sale, right?

She launched her website in January this year, and charges a selling price of $900 per unit. Last In First Out (LIFO) is the assumption that the most recent inventory received by a business is issued first to its customers. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website.

One of the primary reasons businesses opt for LIFO is its potential to reduce taxable income during periods of inflation. By matching the most recent, higher costs of inventory against current revenues, LIFO increases the cost of goods sold (COGS), thereby lowering the reported net income. This reduction in net income translates to a lower tax liability, providing a cash flow advantage that can be reinvested into the business.

This layering effect is particularly pronounced in industries with fluctuating inventory costs, such as manufacturing and retail. The last-in, first-out method is an inventory cost flow assumption allowed in by US GAAP and income tax laws. The LIFO method proponents argue that the LIFO method improves the matching of revenues and replacement costs. However, the cost of ending inventory presented in the balance sheet presents older costs. More importantly, users of the LIFO method say that using LIFO gives them tax savings since they report a lower taxable income. In a standard inflationary economy, the price of materials and labor used to produce a product steadily increases.

The method of looking at the last units purchased is still the same, but under the perpetual system, we can only consider the units that are on hand on the date of the sale. For all periodic methods we can separate the purchases from the sales in order to make the calculations easier. Under the periodic method, we only calculate inventory at the end of the period. Therefore, we can add up all the units sold and then look at what we have on hand. The bad news is the periodic method does do things just a little differently. The strategic use of LIFO during inflation can also help businesses manage their cash flow more effectively.